Ways to Give

Making a Gift to Sauk Prairie Healthcare Foundation

At Sauk Prairie Healthcare Foundation, we consider ourselves fortunate to have such a generous community supporting us. Many donors are past patients who had a good experience with us, or they are a family member of one of our patients and want to show their gratitude with a gift. Other donors are looking for a way to help our organization and reduce their taxes at the same time. Whatever your situation is, we’d love to talk to you about giving. We can discuss the various options and help you arrive at a decision that will be personally gratifying to you, knowing you will be providing for the health of our community.

As always, we’d encourage you to consult your financial advisor, tax professional or attorney before implementing a financial strategy to sure make sure it is suitable to your particular situation.

Ways to Give to Sauk Prairie Healthcare Foundation:

- Gifts of cash, checks, bank withdrawals or ongoing giving

- Gift of Stocks, Bonds, and Mutual Funds

- Gift of Real Estate

- Gift of Life Insurance

- Qualified Charitable Distributions. This includes IRA Required Minimum Distribution (RMDs)

- Donor Advised Funds

- Charitable Lead Trust (CLT)

- Charitable Remainder Trust (CRT)

- Charitable Gift Annuity (CGA)

- Retirement Benefits

- Wills and Bequests

Planned Giving Info Packets:

How to Contact Us

Todd Wuerger, Executive Director

Phone:

608-643-7226

foundation@saukprairiehealthcare.org

Hours: Monday through Friday, 8:30 am to 5:00 pm

Mailing Address

260 26th Street

Prairie du Sac, WI 53578

-

Sauk Prairie Healthcare Foundation funded a ...

More -

Twelve years ago, Kathy Johnson, Judy Spencer, and ...

More -

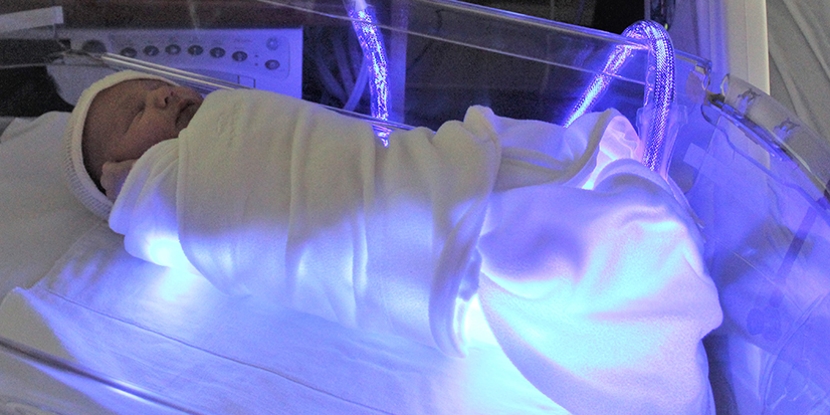

Many newborns need to be treated for jaundice in ...

More -

Before their deaths, longtime area residents ...

More -

Transcript Heather: It was Christmas Eve 2018, and ...

More -

Todd: What is a hero? The common definition is a ...

More -

Transcript Host: We live in a unique and wonderful ...

More -

Greg Beier, an Athletic Trainer at Sauk Prairie ...

More -

We know that access to nutritious food is ...

More -

The pandemic spread quickly, and Sauk Prairie ...

More -

Every year, Sauk Prairie Healthcare Foundation ...

More -

River Valley School District The school district ...

More -

George Culver Community Library The funds were ...

More -

Friends of the Lodi Public Library Funds were used ...

More -

Baraboo Area Homeless Shelter The funds helped the ...

More -

Arena Police Department The grant offset the cost ...

More -

Heights Unlimited Community Resource Center Funds ...

More -

Columbia County Health and Human Services Funds ...

More -

Dane County District One EMS Funds were used to ...

More -

Friends of the Great Sauk State Trail The grant ...

More -

When you're Ms. Wheelchair Wisconsin, you have ...

More -

The people who donate to Sauk Prairie Healthcare ...

More -

Birth Center director Sue Shafranski, Malachi, ...

More -

Give Now Amy: Back when Saunters first started, it ...

More -

April showers bring May flowers…and herbs…and ...

More -

Sauk Prairie Healthcare’s Emergency Department now ...

More -

Eric and Irene Rapp of the Spring Green area ...

More -

Could you use more tax deductions this next year? ...

More -

When you give to Sauk Prairie Healthcare ...

More -

Sauk Prairie Healthcare's fetal loss committee ...

More -

As we turn the calendar to November, many of us ...

More -

Marian Bindl is a positive, glowing force to be ...

More -

Sauk Prairie Healthcare Foundation sponsors Mental ...

More -

The people who give to Sauk Prairie Healthcare ...

More -

When you give to the Sauk Prairie Healthcare ...

More -

By giving to the Sauk Prairie Healthcare ...

More -

Todd Wuerger: We live in a wonderful area. Not ...

More -

Every year, Sauk Prairie Healthcare Foundation ...

More -

Todd Wuerger: If I were to ask you what health ...

More